CJ Attard Insights

Exploring the latest trends and insights in various industries.

Instant Gratification: Exploring the Allure of Instant Payout Systems

Uncover the secrets of instant payout systems. Discover why they captivate millions seeking quick rewards and explore the impact on our choices!

Understanding Instant Payout Systems: How They Work and Their Benefits

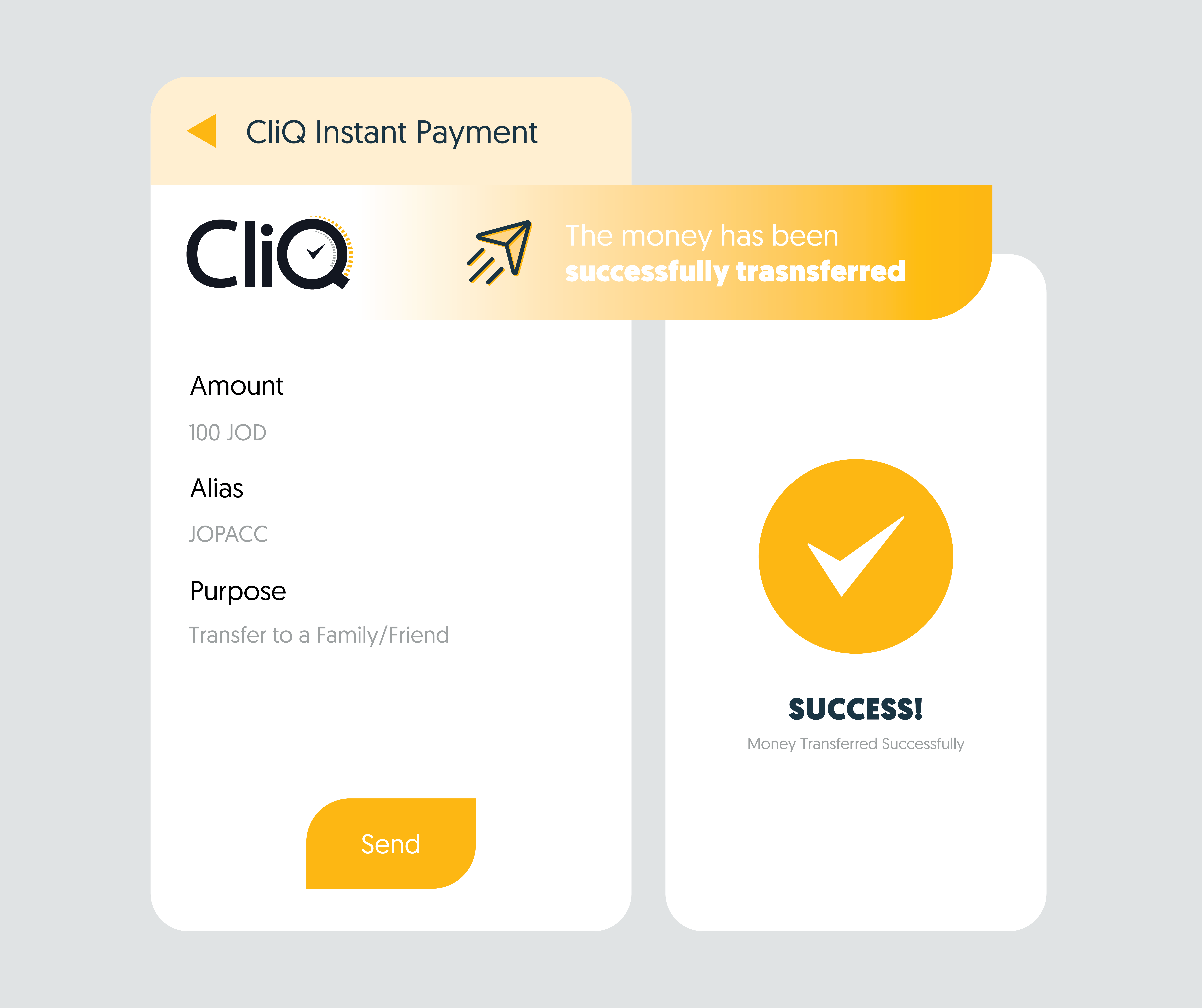

Understanding instant payout systems is crucial for businesses and freelancers looking to manage their finances efficiently. These systems allow users to receive their earnings almost immediately after a transaction, eliminating the typical waiting periods associated with traditional payment methods. The technology behind instant payout systems typically involves digital wallets or blockchain systems that process transactions in real-time. This means that as soon as a customer makes a payment, the funds can be deposited directly into the recipient's account, ensuring swift access to cash flow.

The benefits of using instant payout systems extend beyond mere convenience. First and foremost, they enhance financial agility, enabling businesses to reinvest in operations without delay. Additionally, they can significantly improve customer satisfaction by offering flexible payment options. As transactions are completed quickly, both merchants and customers benefit from a seamless experience. In summary, adopting an instant payout system can not only streamline payment processes but also bolster overall business growth through enhanced cash flow management.

Counter-Strike is a popular tactical first-person shooter game that has captivated gamers worldwide. Players are divided into two teams, terrorists and counter-terrorists, who compete to accomplish specific objectives. If you're looking to enhance your gameplay, consider using a clash promo code to unlock special features or bonuses.

The Psychology of Instant Gratification: Why We Crave Quick Rewards

In today's fast-paced world, the phenomenon of instant gratification plays a crucial role in shaping our behaviors and decisions. This psychological tendency to seek quick rewards is deeply embedded in human nature, often driven by the brain's reward system. When we achieve immediate satisfaction, our brain releases dopamine, creating a sense of pleasure and reinforcing the behavior. As a result, we become conditioned to pursue instant rewards, whether through shopping, social media, or even snacks. The immediate feedback we receive can feel more satisfying than long-term rewards, which may require patience and perseverance.

However, while indulging in instant gratification can provide temporary relief or joy, it can also lead to negative consequences in the long run. Many individuals find themselves caught in a cycle of seeking short-term pleasures, which can detract from long-term goals and mental well-being. For example, overindulgence in quick rewards, like binge-watching a series or excessive online shopping, can lead to feelings of guilt and anxiety. Understanding this psychological mechanism is crucial; by recognizing our cravings for quick rewards, we can develop healthier habits and learn to balance our immediate desires with the benefits of delayed gratification.

Are Instant Payout Systems Worth It? Analyzing the Pros and Cons

In today's fast-paced digital economy, instant payout systems are gaining traction among freelancers, gig economy workers, and businesses looking for quick financial transactions. One of the primary benefits of these systems is the immediate access to funds, which can greatly enhance cash flow and allow for better financial planning. For instance, platforms that offer instant payouts enable users to receive earnings on-demand rather than waiting for traditional payout cycles. This can be especially beneficial for those who rely on consistent cash flow to meet their living expenses.

However, there are notable downsides to consider when evaluating whether instant payout systems are worth it. One major drawback is the potential for higher fees associated with these services, which may cut into overall earnings. Additionally, the reliance on instant payouts can lead to poor financial habits, such as overspending or lack of saving, as individuals may feel less urgency to manage their funds responsibly. Ultimately, weighing the pros and cons is crucial for anyone considering adopting these systems for their financial transactions.