CJ Attard Insights

Exploring the latest trends and insights in various industries.

Term Life Insurance: The Safety Net You Didn't Know You Needed

Discover the hidden benefits of term life insurance—your essential safety net for financial security. Don't wait, safeguard your future today!

Understanding the Basics of Term Life Insurance: Is It Right for You?

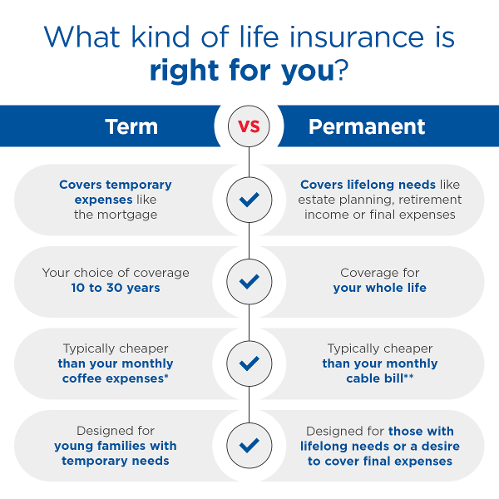

Term life insurance is a straightforward and affordable option designed to provide financial protection for your loved ones in the event of your untimely passing. This type of policy offers coverage for a specified term, typically ranging from 10 to 30 years, during which your beneficiaries will receive a death benefit if you pass away. One of the primary advantages of term life insurance is its cost-effectiveness, as premiums tend to be significantly lower compared to permanent life insurance policies. This makes it an accessible choice for individuals and families seeking to ensure financial security without breaking the bank.

It's essential to consider your personal circumstances when determining if term life insurance is right for you. Start by evaluating your financial obligations, such as mortgage payments, education expenses, or other debts. Additionally, consider the needs of your dependents and how long they may rely on your income. If you find that your responsibilities are likely to decrease over time—like children growing up or debts being paid off—term life insurance can be an ideal solution. Remember that while it provides vital short-term coverage, it may not be the best option for those seeking lifelong protection or investment accumulation.

5 Reasons Why Term Life Insurance is a Crucial Part of Your Financial Plan

Term life insurance plays a pivotal role in a comprehensive financial plan, and here are five compelling reasons why. First, it offers affordable coverage for a specified period, making it accessible for individuals and families who may have budget constraints. With lower premiums compared to whole life insurance, you can secure significant protection without straining your finances. Second, term life insurance provides a safety net for your loved ones, ensuring that in the event of an untimely passing, they are not burdened with financial instability. This peace of mind is invaluable, especially for families relying heavily on one income source.

Third, term life insurance can be tailored to fit your long-term financial goals. Whether you're looking to cover a mortgage, fund your children's education, or replace lost income, a term policy can be designed to meet these specific needs effectively. Fourth, the simplicity of term life insurance makes it an attractive option; there are no complicated investment components, allowing policyholders to focus solely on the coverage. Finally, once your financial obligations have been met, your term policy can expire without any penalty, leaving you free to redirect your funds towards other financial ventures. In summary, incorporating term life insurance into your financial strategy is not just wise but essential for safeguarding your family's future.

What Happens When Your Term Life Insurance Expires?

When your term life insurance expires, you may face several important decisions regarding your financial future and your family's protection. Unlike whole life insurance, term policies provide coverage for a specified duration, such as 10, 20, or 30 years. Once this period ends, the policyholder will receive no payout, and the policy cannot be renewed unless an option for renewal was included in the original agreement. At this point, many individuals must reassess their insurance needs and consider whether they still require life insurance coverage based on their current financial situation and dependents.

There are typically a few options available when your term life insurance expires:

- Renew the Policy: You may have the option to renew your current policy at a higher premium based on your age and health.

- Convert to Permanent Insurance: Some policies allow a conversion to whole life insurance without a medical exam.

- Let It Expire: If you no longer need coverage, you can let the policy lapse, but this means no financial protection for your beneficiaries.