CJ Attard Insights

Exploring the latest trends and insights in various industries.

Crack the Code: Discover Hidden Gems in Auto Insurance Discounts

Unlock secret auto insurance discounts and save big! Dive into hidden gems for the best deals on your coverage today!

Top 10 Auto Insurance Discounts You Might Be Missing

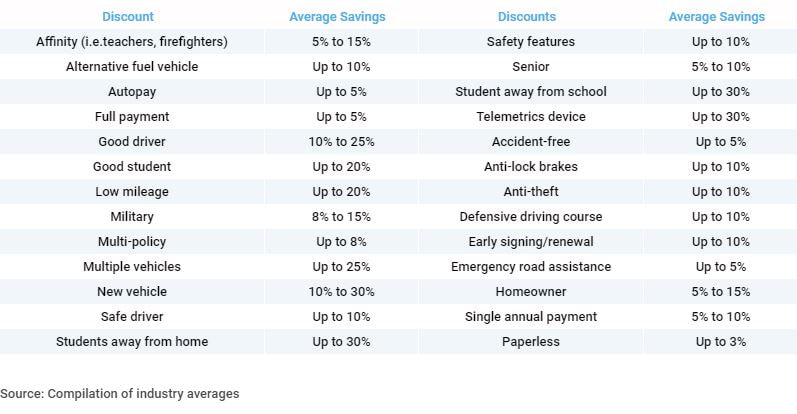

When it comes to saving money on auto insurance, many drivers overlook potential discounts that could significantly reduce their premiums. Here are top 10 auto insurance discounts you might be missing:

- Multi-Policy Discount: Bundling your auto insurance with other policies, such as home or renters insurance, can lead to substantial savings.

- Safe Driver Discount: Maintaining a clean driving record without accidents or violations can earn you this valuable discount.

- Good Student Discount: Students with good grades may qualify for discounts as they are considered lower risk.

- Low Mileage Discount: If you drive less than a predetermined amount of miles per year, you may be eligible for a discount.

Continuing our list, here are more discounts that you may not be aware of:

- Military Discount: Active duty and veteran military personnel often receive special discounts.

- New Car Discount: Newer vehicles typically come with safety features that reduce the likelihood of accidents, earning you a discount.

- Defensive Driving Course Discount: Completing an accredited defensive driving course can help reduce your premiums.

- Affinity Group Discount: Membership in certain organizations or employers can grant you special rates with certain insurers.

- Payment Plan Discount: Opting for annual payment over monthly payments can sometimes earn you a discount on your premium.

How to Maximize Your Savings: A Guide to Auto Insurance Discounts

Maximizing your savings on auto insurance can significantly reduce your overall costs, making it essential to understand the available auto insurance discounts. Many insurance providers offer a variety of discounts that can apply to your policy. Some common categories include safe driving discounts for accident-free records, multi-policy discounts for bundling auto with home or renters insurance, and good student discounts for young drivers maintaining a high GPA. Additionally, you may qualify for discounts based on the vehicle you drive, such as anti-theft devices and hybrid vehicle incentives. To ensure you are taking full advantage of these options, it's crucial to do your research and ask your insurance provider about all the discounts they offer.

Another effective strategy to maximize savings is to regularly review and compare your current auto insurance policy. Shopping around annually or when your policy is up for renewal can reveal better rates and potential discounts that were not previously available. Using comparison tools or working with an insurance agent can simplify this process. When obtaining quotes, be sure to inquire about specific discounts such as those for low mileage, loyalty rewards, or even military service. By remaining proactive and aware of your options, you can increase your chances of finding a policy that not only meets your needs but also saves you money.

Are You Getting All the Discounts Available on Your Auto Insurance?

When reviewing your auto insurance policy, it’s essential to ensure you’re taking full advantage of all the discounts available to you. Many insurance companies offer various types of discounts that can significantly lower your premium. These can include safe driver discounts, multi-policy discounts for bundling home and auto insurance, and even discounts for completing defensive driving courses. Make a list of potential discounts you might qualify for and reach out to your insurance provider to discuss how you can maximize your savings.

In addition to the standard discounts, don’t overlook lesser-known options that could apply to your unique situation. For example, if you drive a car with advanced safety features or have a vehicle that is less likely to be stolen, you may qualify for additional discounts. Furthermore, maintaining a good credit score can also impact your rates positively. By regularly reviewing your policy and staying informed about available discounts, you can ensure you are not leaving any money on the table when it comes to your auto insurance.